Summary:

Tarillium claims to offer online trading in forex, crypto, or CFDs. However, users have reported issues such as withdrawal delays, unclear regulation, and hidden fees. This Tarillium Broker Review checks whether Tarillium is safe or a potential scam.

About Tarillium

-

Website: https://www.tarillium.com/en/home

-

Address: 122 Leadenhall Street, London, UNITED KINGDOM, EC3V 4AB

-

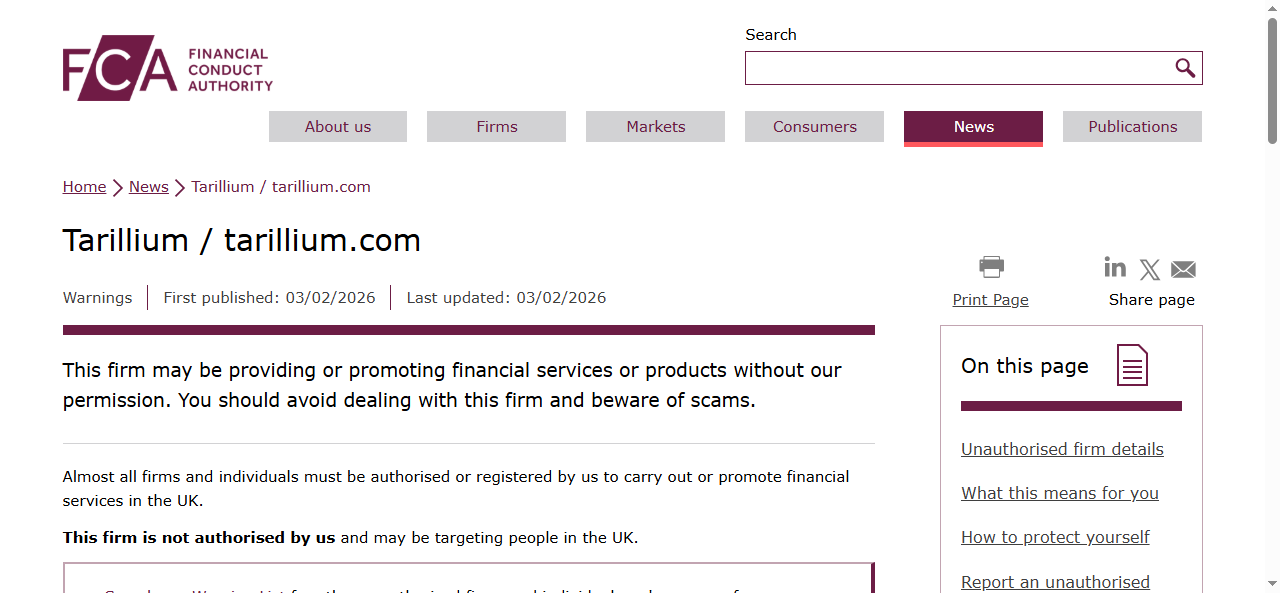

Regulatory Warning: Financial Conduct Authority (UK)

-

Domain Blacklist Status: It seems there is no direct mention of this domain being on a blacklist.

Before investing, confirm that this broker is licensed by a recognized financial authority.

The Financial Conduct Authority (FCA) has issued a warning regarding Tarillium, indicating that the broker is not authorized to provide financial services in the UK. An FCA warning means the firm is operating without proper regulatory approval and investor protections such as access to the Financial Ombudsman Service or compensation schemes may not apply. This type of alert is a major red flag for investors and strongly suggests avoiding any deposits or trading activity with the platform.

The Tarillium scam has been increasingly discussed across investor protection forums and watchdog platforms. Tarillium presents itself as a modern investment platform focused on crypto and technology stock opportunities, but several warning indicators suggest it may not be a trustworthy operation. A proper Tarillium Broker Review shows that the platform lacks verified transparency and credible oversight, which are essential factors when choosing a safe broker.

Reports of Fund Access and Withdrawal Barriers

One of the most serious red flags linked to this case is restricted fund access after deposit. Patterns reported by affected users show that once money is invested, account holders face repeated barriers when attempting withdrawals. These often include unexpected conditions, additional payment demands, and approval delays. Such behavior is commonly associated with a Tarillium broker scam, where control over funds is effectively removed from the investor.

Regulatory and Authorization Issues

Research also indicates regulatory concerns connected to potential Tarillium fraud activity. The platform has been flagged as unauthorized by multiple financial oversight sources and linked to boiler-room style operations. These schemes typically rely on aggressive outreach, exaggerated profit projections, and selective or fabricated credibility signals to gain investor trust.

High-Pressure Tactics and Misleading Promotions

Risk assessments show that suspicious platforms in this category often promote unrealistic returns through sponsored articles, advertorial-style content, and persistent sales communication. These pressure tactics are designed to rush investor decisions without allowing time for proper verification — a key warning sign highlighted in many Tarillium review summaries.

Based on complaint trends, regulatory flags, and operational behavior, the risk level appears high. Investors should treat Tarillium with extreme caution, verify licenses independently, and avoid sending money to any platform that cannot prove legitimate authorization.

Is Tarillium Regulated?

Regulation is the key sign of a trusted broker.

Tarillium does not show proof of regulation from major bodies such as FCA, ASIC, CySEC, or FINMA.

Unregulated brokers can operate without supervision, making your funds unsafe.

Report a scam quickly and securely with guided steps, fast complaint submission, and expert help to take action against suspicious online broker activity.

Common Red Flags

If you notice these signs, proceed with caution:

-

Missing Regulation: No valid license or unverifiable claims.

-

Withdrawal Problems: Delayed or denied payouts, hidden bonus conditions.

-

Hidden Charges: Extra fees for withdrawals, inactivity, or account closure.

-

Deposit Pressure: Repeated calls or messages to invest more money.

-

Fake Reviews: Generic 5-star reviews, while negative feedback is removed.

Even one of these red flags can be a serious warning.

Safety Checks Before You Deposit

Follow these quick checks to protect your funds:

-

Verify the License: Confirm the broker’s registration on official regulator websites.

-

Read Withdrawal Terms: Watch for restrictions or hidden fees.

-

Contact Support: Test response time and clarity.

-

Use a Demo Account: Compare demo and live trading performance.

-

Start Small: Deposit a small amount and test a withdrawal first.

-

Read Independent Reviews: Check reliable forums or third-party sites.

Why Regulation Matters

Regulated brokers must:

-

Keep client funds in separate accounts

-

Offer dispute resolution options

-

Submit to regular financial audits

Unregulated brokers are not bound by these rules, putting investors at high risk of loss.

Final Verdict: Is Tarillium a Scam?

Based on reports and checks, Tarillium shows several risk indicators. The lack of verified regulation and user complaints raise serious doubts about its credibility.

Avoid depositing large amounts until full verification is confirmed. Always choose licensed, transparent brokers that comply with financial regulations.

FAQs

1. Is Tarillium safe to use?

No verified license or regulator listing means it is not safe for investors.

2. How can I verify if Tarillium is regulated?

Search for the broker’s name on official regulator websites such as FCA, ASIC, or CySEC.

3. What should I do if Tarillium doesn’t let me withdraw?

Stop depositing, document all communication, and contact a recovery service like Report Scam.

4. Can I get my money back?

In some cases, yes. Fund recovery through chargebacks or legal reporting may be possible.

5. How can I avoid trading scams?

Always check for regulation, read user reviews, and start with small test deposits before investing heavily.

Need Help Recovering Funds?

If you lost money to Tarillium or a similar trading platform, Report Scam can help you take action.

We provide:

-

Step-by-step guidance to report fraud

-

Help collecting and organizing transaction evidence

-

Support in exploring chargebacks and recovery options

Contact us today for a free consultation and learn how to reclaim your funds.

Your path to justice begins here—our team is committed to supporting individuals affected by financial misconduct. Read about Chargebacks

To read more about Scam Brokers and their Reviews, Visit Scam Brokers Page to avoid Cryptocurrency trading scams, Forex trading scams, or other online scams.

Connect with us:

Facebook Page – Visit – ReportScam Community

Twitter – Report Scam Forum

Instagram – Reportscamcommunity

You can Trust Report Scam Community! as we have experience!